13 Key Shipping Terms You Need to Know

If you’re new to the world of shipping and parcel delivery, you might have come across a lot of phrases and acronyms that you don’t recognise. At first glance, all of this jargon can be overwhelming, which is why we’ve pulled together 13 of the key terms you need to know when it comes to arranging a parcel delivery.

1. Carrier

A carrier is quite literally the company ‘carrying’ your shipment. They’re responsible for making sure that your parcel gets from its origin to its end destination, and there are plenty to choose from. It’s important to choose your carrier carefully, as this can have an impact on everything from speed, cost, and the reliability of your parcel delivery (and that’s exactly what ParcelBroker is here to help with!).

2. Access Point

An access point is a local store or pickup location where parcels can be collected or dropped off. This is especially useful for things like last-minute deliveries or for senders and recipients who are tight on time and have poor flexibility.

3. CPC (Customs Procedure Codes)

Customs Procedure Codes (often abbreviated to CPC) are numeric codes used on customs declarations that indicate the type of goods movement. That means things like whether the goods are an export, import, or a temporary admission. Having the right CPC means that your shipment complies with the legal customs processes of the countries involved. Not sure which code is right for your shipment? Check out our guide here.

4. VAT

VAT (Value Added Tax) is a tax that is applied to goods and services. Often, VAT is included in the cost of shipping or customs duties, but it’s important to understand what the rules are to avoid expensive, unexpected charges.

5. EORI Number

EORI stands for Economic Operators Registration and Identification and is a number that is required for businesses trading goods with countries outside of the UK. Authorities rely on this to track shipments being made across borders, and an EORI number is essential for customs clearance.WEIGHT IMAGE

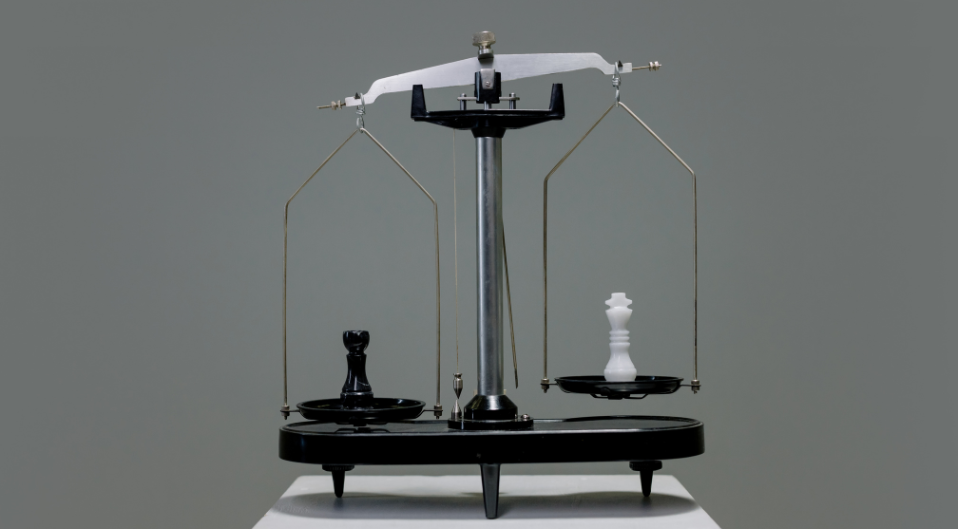

6. Volumetric Weight

Volumetric weight is also sometimes referred to as dimensional weight, and it’s a pricing technique that takes package size into account. If you have a large, but light parcel, then the volumetric weight might be higher than its actual measured weight, and carriers will charge accordingly.

7. Import Duty

Import duty is a tax that’s applied to goods brought into a country. It’s usually calculated based on the item’s value and HS code (if you’re not sure what an HS code is, keep reading to find out). It’s important to know what your import duty charge is likely to be, as this will help you to price an international parcel delivery correctly. Failure to do this could lead to unexpected charges and delays.

8. HS Code

Harmonised System (HS) codes are numerical codes that are recognised internationally and classify products. They help to determine which duties and taxes should be paid on the parcel and are required for customs documentation. If you don’t know where to find your HS code, then we have a guide covering how to calculate import duties and taxes here.

9. Certificate of Origin

This is a document that confirms which country the goods were manufactured in. This information can influence duties and restrictions on deliveries in certain locations, and the certificate is often required by customs authorities.

10. CIF and NIF Numbers

CIF (Código de Identificación Fiscal) and NIF (Número de Identificação Fiscal) are tax ID numbers used in some countries like Spain and Portugal. They help customs authorities to validate tax and details about businesses when parcels are being shipped internationally.

11. Export Accompanying Document (EAD)

This document is generated after an export declaration is submitted. It’s really important that it’s attached to your goods and remains there until the shipment leaves the country, as it serves as proof that your delivery is leaving a customs territory.

12. AES Filing

Automated Export System (AES) filing is used in the United States and is the electronic submission of export information to the authorities. It is crucial to making sure that shipping from the US to other countries is compliant.

13. ITN

An Internal Transaction Number (ITN) is the confirmation code that is issued after an AES filing. It confirms that all of the necessary export data has been submitted, and without this number, deliveries from the US will be delayed or even denied at customs.

The parcel delivery and shipping world is full of terms that might seem confusing and difficult to understand at first. However, while some might be ‘nice to know’, other terms are crucial to know if you want to avoid unnecessary delays or fees.To compare carriers and get the best price for your parcel delivery, use our handy comparison form here. If you’re stuck and struggling to understand some of the phrases that you’re coming across, then our expert team are on hand and happy to help.